In my last commentary, I wrote about the misleading math behind the rent vs. buy calculation. My main point was that focusing on the direct, total monthly costs of renting vs. buying misses the important fact that a significant portion of every mortgage payment goes toward the principal balance, building equity for the homeowner.

That principal payment is really a forced savings program which grows over time. And that’s a key reason why homeowners on average have much more accumulated wealth than renters.

The article struck a nerve, and a boatload of internet chatter. I’ve even received some criticism that my math was itself misleading because I didn’t include property taxes, insurance, and costs for maintenance and repair, thus making homeownership look less expensive than it really is.

So, by popular demand, I’m back to take a deeper dive into the math to illustrate—clearly and simply—how owning a home produces wealth over time.

For those who want to dive into even more detail, the rent vs. buy calculator on realtor.com® factors in all the direct and indirect costs of buying versus renting over a 30-year span.

The calculator assumes that any money saved monthly from renting is invested. And just like academic research has shown, the total-cost view shows that buying costs less than renting in the long term, in most cases.

As I did before, I am keeping this illustration as simple (yet accurate!) as I can by focusing on a fictitious buyer who fits the national median. I did have to make a few key assumptions for the calculation, and here they are:

- Property taxes and insurance costs are factored into the monthly payment of buying, using averages for the country. I also factored in expected upkeep based on a widely assumed benchmark for home maintenance and repair costs over time.

- I am assuming that inflation is 2% per year and determines the future home value and rent. It should be noted that home appreciation over time typically outpaces inflation by about 1%. However, rather than projecting bullish gains, I am sticking to a home-value increase in line with inflation to keep this focused on the wealth-building aspects of the mortgage as opposed to how the home asset itself appreciates like an investment.

- To compare the ledger of the renter against that of the owner, I’m using the average rent from the Department of Housing and Urban Development’s 2016 fair market rent data as the baseline.

- The difference between the monthly costs of buying and renting creates the savings pool available to the renter.

This more complete view does alter a few simplistic points I made in the first piece, when I said that you needed to find a place to rent for no more than the $976 mortgage payment in order to beat the value of owning. You might think that’s deceptive when you take into account the added monthly costs of property taxes, homeowners insurance, and maintenance.

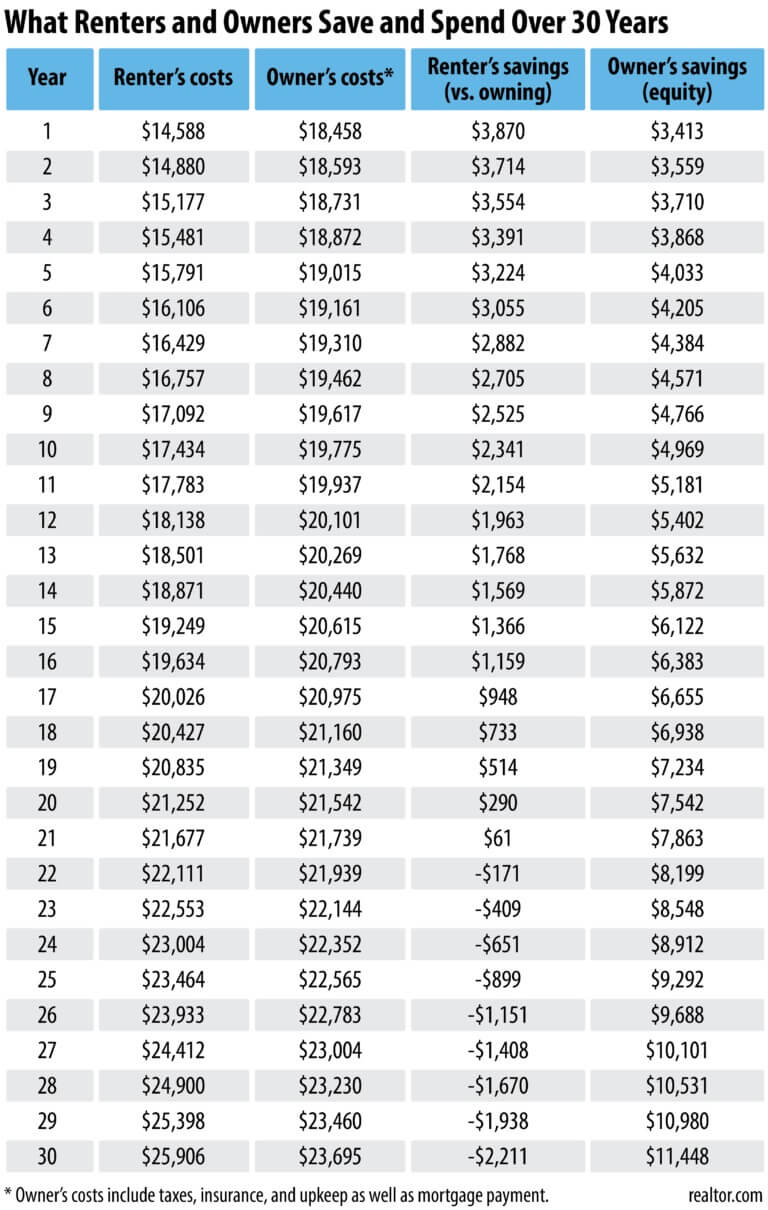

With those additional costs on the owning side, a renter could spend up to $1,538 a month on housing to match an owner’s spend. But while that sounds like a huge difference, our illustration proves that owning still wins over time. (See a chart with the numbers below.)

The home buyer in our illustration will have built up a bit more than $3,400 in equity in year one. In this extended example, the renter at the average national rent will pull ahead of the buyer in year one by saving $3,870—a sweet $470 more than the owner. Remember that the illustration assumes the renter dutifully saves every penny compared with what he or she would have spent buying instead.

As you probably know by now, in most places in the country, initial monthly costs favor renting over buying. It’s not a surprise to see the renter theoretically being able to pull ahead in Year 1 as a result.

But it doesn’t take long for the owner to pull ahead in accumulated savings, because the monthly mortgage payment is fixed and a growing portion of each payment is building up more equity.

In Year 2, the renter would save $3,714, just barely beating the owner’s $3,559 in equity.

By Year 3? The tide shifts to favor the owner, thanks to the growing principal payment and the compounding impacts of higher inflation adding to the monthly rent. In this year, the owner saves $3,710 in added equity while the renter saves $3,554.

Since rent started so much lower and we’re keeping inflation assumptions low at 2%, it takes 22 years before the monthly out-of-pocket costs of renting exceed the monthly costs for our owner. But every year past Year 2 still results in the owner saving more simply by virtue of the principal portion of the payment getting larger. And by Year 22, when renting actually costs more on a monthly basis, the principal payment amounts to $8,199.

With the renter not building equity and paying more in monthly costs from Year 22 on, the owner moves ahead rapidly in accumulated savings. Worse still for the renter, inflated rents are pushing what used to be a net savings, compared with the fixed mortgage payment, into the red.

In Year 31, the financial difference between the two households in our illustration is stark. The renter is then spending $2,202 in rent. The owner, mortgage-free, is paying only property takes, insurance, and upkeep for about $1,020 per month. The owner also has a home that is worth around $450,000 in inflation-adjusted dollars.

The 30-year mortgage works wonders in locking down today’s costs while also forcing the accumulation of savings over time through the principal payments. If your time horizon is less than a few years, renting comes out ahead. Buy beyond a few years, homeownership typically wins out. This is why owning a home, all things considered, is a path toward building wealth.