Older Buildings, Amenities, Higher Floors Can Boost Cost and Days on Market

In the NVAR region, modestly priced homes are typically either condos or townhomes, and these property types accounted for 93.4 percent of all homes that sold for less than $400,000 so far in 2016. But unlike fee simple ownership of single-family detached homes, building management and much of the building's maintenance is financed collectively through funds generated by a condo fee. High condo fees are often associated with high-amenity buildings, but the building type and age also affect the fees. Condo fees have increased over time and change the affordability calculations for both potential buyers and current owners.

CONDO FEES

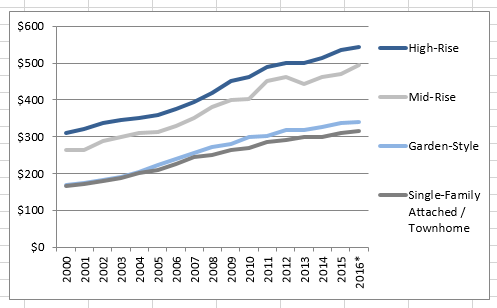

Since 2000, the median condo fee in the NVAR region has increased an average of 4-5 percent per year for all property types. Condo fees have risen faster than the national rate of inflation, but may reflect local price increases.

The median condo fee in a garden-style building (those with 1-4 floors) had the sharpest increase and rose an average of 4.8 percent annually between 2000 and 2015. Despite the relatively steep growth rate, condo fees in this property type remain lower than those in mid-rise (5-8 floors) and high-rise (9+ floors) buildings. The lowest growth occurred in high-rise buildings where condo fees increased 3.7 percent annually between 2000 and 2015.

CONDO SIZE, BUILDING TYPE

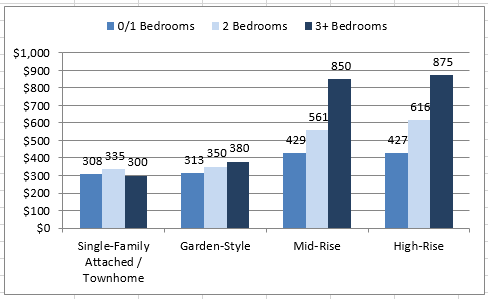

Condo fees may vary by the size of the unit, but the patterns differ depending upon the building type. For both mid-rise and high-rise buildings, the median condo fee per square foot was consistent for all unit sizes. In a mid-rise building, the median fee is typically about $0.50 per square foot. The median in a high-rise is about $0.53 per square foot. As a result, condo fees increase proportionally by the size of the unit.

On a square-foot basis, condo fees in townhomes and garden-style buildings become more affordable as the unit size increases. The median fee per square foot for a unit in garden-style buildings falls from $0.43 for a 1-bedroom unit to $0.29 per square foot for a 3-bedroom unit. The decrease is even sharper for townhomes, and fees drop from $0.37 per square foot for a 1-bedroom to $0.18 per square foot in a 3-bedroom unit. The total fee for units in townhomes and garden-style buildings is relatively constant across all unit sizes.

BUILDING AGE IMPACTS FEES

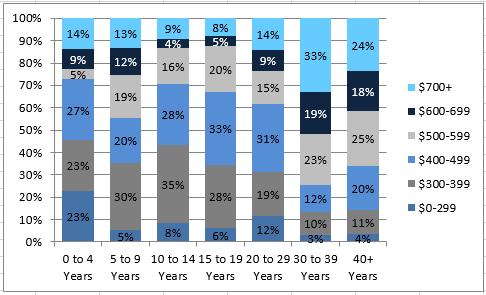

Condo fees tend to rise as the building ages, especially in mid-rise and high-rise buildings. During the next 15 years of a building's life, the distribution is relatively stable and 35-45 percent of the units have fees of less than $400.

Once the building becomes 20 years old, there is a modest uptick in the share of homes with higher fees. About 38 percent of homes in mid-rise or high-rise buildings aged 20 to 29 years old have fees higher than $500, compared to 32.8 percent in buildings aged 15 to 19 years old.

"Based on past trends, condo owners should budget for a 4-5 percent increase per year in the base condo fees, or 1-2 percentage points higher than inflation. This growth excludes special assessments, which may be less predictable."

After a mid-rise or high-rise building reaches 30 years, the shift in fees is dramatic. These homes were twice as likely to have fees of $500 or more than their younger counterparts. Three-quarters (74.4 percent) of homes that were between 30 and 39 years old when they sold in 2015 had fees of at least $500. Similarly, 66 percent of homes older than 40 years had increased fees.

HOUSING AFFORDABILITY

In general, housing costs should be no more than 30 percent of a household's gross income. In order to stay at or below this threshold, a household would need to earn an additional $4,000 for every $100 per month in condo fees. While the increment is relatively small, the total can add up quickly. A potential buyer looking at a home with condo fees of $300 per month would need an additional $12,000 in annual income compared to a home without fees. Some of these costs may be offset by a decrease in utilities, maintenance or other costs, but the owner may have less control over the fees and their increases. This may be particularly problematic for households on a fixed income, including retirees.

For households looking to buy, higher condo fees reduce the home price that is affordable to them and also shift the rent/buy timeframe. According to

Realtor.com, an increase of $100 in condo fees decreases the home price that a buyer can afford by nearly $20,000. This means that a condo selling for $280,000 with a $100 condo fee would be equally affordable as a $200,000 home with a $500 fee.

This trade-off between home price and monthly fees seems to be reflected in closed sales data in 2016; homes that sold for less than $200,000 are more likely to have condo fees of $500 or more than those selling for between $200,000 and $400,000. The condo fees in higher-priced units also tend to be higher, which may reflect greater building amenities.

This trade-off between home price and monthly fees seems to be reflected in closed sales data in 2016; homes that sold for less than $200,000 are more likely to have condo fees of $500 or more than those selling for between $200,000 and $400,000. The condo fees in higher-priced units also tend to be higher, which may reflect greater building amenities.

The effect of condo fees on a rent/buy calculation is largely dependent upon the down payment amount. High condo fees will have a minimal effect for buyers who put 20 percent down. But buyers who put 3 percent down will see the break-even point increase exponentially as condo fees rise.

HOUSING DEMAND

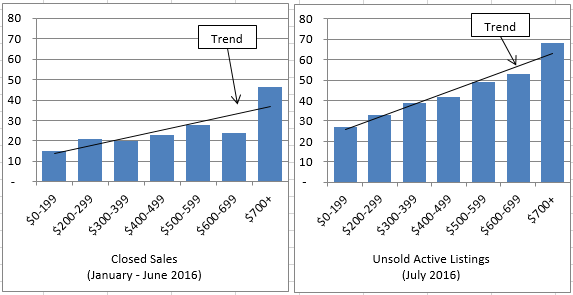

Homes with higher condo fees stay on the market longer than those with lower fees. For condo properties that sold during the first half of 2016, those with fees under $200 dollars were typically on the market for 15 days. Those with monthly fees between $200 and $700 were most likely to sell within 20-30 days, while those with higher fees took nearly twice as long to sell, at 47 days.

For condos that were unsold at the beginning of July of this year, the pattern is more linear. The median days-on-market increases by about five days for every additional $100 in fees, until the fees reach $700 per month. The median unsold condo with a fee of over $700 has been on the market for 68 days.

CONCLUSION

Based on past trends, condo owners should budget for a 4-5 percent increase per year in the base condo fees, or 1-2 percentage points higher than inflation. This growth excludes special assessments, which may be less predictable. Owners in older buildings should expect fees to be higher, as should owners in mid-rise and high-rise buildings. Homes with higher fees take longer to sell, on average, which indicates that buyers are aware of the long-term implications of the fees.

Jeannette Chapman is a research associate with the George Mason University Center for Regional Analysis.