There has been a great deal of discussion in the past few years about the affordability of housing—or the lack thereof—in Northern Virginia. The conversation typically focuses on the rising sale prices of housing units but does not often consider the true measure of housing affordability: the relationship between a household’s income and its ability to purchase a home.

According to the most recent five-year average data from the Census Bureau’s American Community Survey (2008-2012), the median income of all homeowner households in the NVAR region is about $134,000. This region includes Arlington and Fairfax counties and the independent cities of Alexandria, Fairfax and Falls Church. From January through October, 2014, there were 15,520 residential sales in Northern Virginia, with a median sale price of $480,000. This represents a ratio of median income to median housing price of 27.9 percent at the regional level. Generally speaking, an income-to-price ratio above this level means that a typical household can afford to live in its home without stretching its budget beyond typical levels. A lower income-to-value ratio means that a household must spend a higher than normal share of its income on housing in order to live in that area.

Median sale prices in 2014 have varied greatly by ZIP code area, from a low of $299,950 in ZIP 22041 (Bailey’s Crossroads) to a high of $1.2 million in ZIP 22066 (Great Falls)—the ratio between the highest and lowest median prices is thus 4.00. The variation among the incomes of homeowner households is considerably smaller, though; homeowner households in ZIP 22066 have a median income of $214,000 compared with $103,000 in ZIP 22041, a ratio of just 2.08. As a result, the current income-to price ratio in ZIP 22066 is 17.9 percent, making it the least affordable ZIP code in the region. By contrast, ZIP 22041 is one of the region’s most affordable ZIP codes, with an income-to price-ratio of 34.4 percent.

Median sale prices in 2014 have varied greatly by ZIP code area, from a low of $299,950 in ZIP 22041 (Bailey’s Crossroads) to a high of $1.2 million in ZIP 22066 (Great Falls)—the ratio between the highest and lowest median prices is thus 4.00. The variation among the incomes of homeowner households is considerably smaller, though; homeowner households in ZIP 22066 have a median income of $214,000 compared with $103,000 in ZIP 22041, a ratio of just 2.08. As a result, the current income-to price ratio in ZIP 22066 is 17.9 percent, making it the least affordable ZIP code in the region. By contrast, ZIP 22041 is one of the region’s most affordable ZIP codes, with an income-to price-ratio of 34.4 percent.

Some patterns are clear from the region’s ZIP code level income-to-price ratios. First, many of the region’s highest priced ZIP codes (e.g. 22066, 22101, 22207, 22046) are also among its least affordable, with income-to-price ratios below 22.5 percent. Second, there is a pronounced increase in housing affordability levels as one travels further outside the Beltway. The cluster of ZIP codes along the Beltway between McLean and Springfield all tend to be unaffordable, with income-to-price ratios in the 20-25 percent range. The next ring out, stretching from Fair Oaks to Clifton, is somewhat more affordable, and the Chantilly/Centreville area tends to be far more affordable, with six contiguous ZIP codes having income-to-price ratios in excess of 30 percent.

There are several closer-in and/or higher value ZIP codes that are actually quite affordable relative to income, though. These include the Court House/Clarendon area (ZIP 22201), the Landmark/Bailey’s Crossroads area (ZIPs 22041, 22302, 22304, 22311, 22312), Kingstowne (ZIP 22315), and the Springfield/Burke area (ZIPs 22152, 22153, and 22015). All of these ZIP codes have income-to-price ratios that are above the regional median of 27.9 percent.

Another consideration in examining affordability is how current sales trends compare to the overall value of housing in each ZIP code area. In addition to having income data, the American Community Survey also includes a measure of median home value for all owner occupied housing in each ZIP area. The 2008-2012 median home value for the region’s existing stock is about $493,000, which is actually 2.7 percent higher than the $480,000 median price of all residential sales from January to October 2014. This is likely the result of an increased percentage of condominium and townhouse sales, rather than an actual decrease in home values.

“...homebuyers in Northern Virginia seem to be willing to pay a premium for single-family homes in desirable locations, while those purchasing townhouses or condos do not seem to want to stretch their budgets as much.”

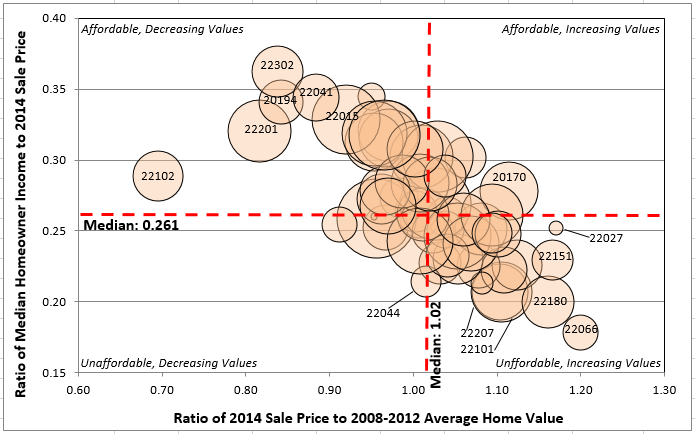

A look at the relationship between affordability and differences between prior home value and 2014 sales prices allows classification of each ZIP code into one of four types: 1) Affordable, Increasing Values; 2) Affordable, Decreasing Values; 3) Unaffordable, Increasing Values; 4) Unaffordable, Decreasing Values. Figure 3 displays this information for each ZIP code in the region.

The clearest finding is that the areas in the region that are remaining affordable are those with more condos and townhouses, such as 22102 (Tysons North), 22201 (Court House/Clarendon), 22302 (North Ridge/Parkfairfax), 20194 (Reston North), 22041 (Bailey’s Crossroads), 22015 (Burke). On the other hand, areas that are becoming more unaffordable are those with predominantly single-family housing: 22066 (Great Falls), 22180 (Vienna), 22101 (McLean), 22207 (North Arlington), and 22151 (North Springfield, Kings Park).

IMPLICATIONS OF AFFORDABILITY ISSUES

As mentioned at the outset, a true measure of housing affordability must account for both income and home prices. For the most part, the least affordable areas in Northern Virginia share two characteristics: 1) they are located closer in to Washington, DC; and 2) they have primarily single-family housing. In these areas, households have proven willing to pay more than they should optimally pay in order to purchase their homes. Conversely, the region’s more affordable areas are those located further out and/or those with more townhouses or condominium units.

These findings are potentially important to those buying and selling real estate, as homebuyers in Northern Virginia seem to be willing to pay a premium for single-family homes in desirable locations, while those purchasing townhouses or condos do not seem to want to stretch their budgets as much. Prices for high-end, single-family housing are therefore likely to continue to increase throughout the region. While this is welcome news for sellers at the top end of the market, it is problematic for prospective buyers, as single-family housing is likely to be harder to find. This factor is likely to generate additional demand for townhouse and condo units in the coming years.

David Versel is a Senior Research Associate with the George Mason University Center for Regional Analysis.